Daily Leverage Certificates

DLC Hotline: (65) 6226 2828

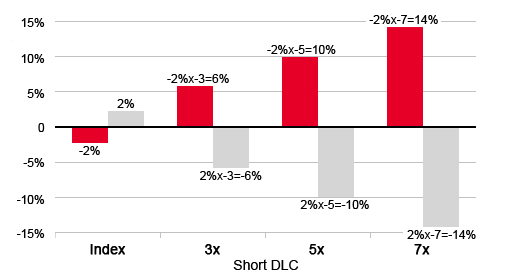

Long DLCs allow you to generate leveraged return when the Underlying Asset goes up. On the other hand, Short DLCs increase in value when the Underlying Asset goes down, allowing investors to achieve positive and leveraged return during market downturn.

| Underlying Stock | 5x Long | 5x Short | ||||

|---|---|---|---|---|---|---|

| Stock Name | Counter Code | Price | DLC Counter Code on SGX |

Price | DLC Counter Code on SGX |

Price |

| DBS | SGX - DBS | 55.020 (-0.04%) | LQSW | 1.220 (+0.41%) | SZWW | 0.083 (0.00%) |

| Genting SingaporeNEW | SGX - GENS | 0.720 (0.00%) | PFTW | 0.220 (-2.22%) | ||

| Keppel | SGX - KEP | 10.070 (-1.47%) | GSEW | 2.440 (-5.43%) | YKEW | 0.113 (+5.61%) |

| OCBC | SGX - OCBC | 19.150 (-0.26%) | TUAW | 1.220 (-0.41%) | MPOW | 0.157 (+0.64%) |

| Singtel | SGX - ST | 4.630 (-0.64%) | XNEW | 0.645 (-2.27%) | GLJW | 0.595 (+1.71%) |

| UOB | SGX - UOB | 34.660 (-0.17%) | W9AW | 0.108 (-0.92%) | 9XCW | 0.415 (+1.22%) |

| Venture | SGX - VMS | 15.030 (-0.33%) | DVSW | 0.805 (-1.23%) | ||

| WilmarNEW | SGX - WIL | 3.050 (-0.65%) | KRMW | 0.470 (-2.08%) | 9PXW | 0.390 (+2.63%) |

| YangzijiangNEW | SGX - YZJSGD | 3.490 (0.00%) | ||||

| AIANEW | HKEX - 1299 | 81.050 (+2.60%) | ||||

| CCBNEW | HKEX - 939 | 7.570 (-0.92%) | ||||

| CNOOC | HKEX - 883 | 20.860 (-0.10%) | MKKW | 0.960 (0.00%) | EOOW | 0.092 (+1.10%) |

| Galaxy EntertainmentNEW | HKEX - 27 | 38.960 (+0.05%) | WIAW | 0.290 (0.00%) | ||

| Geely AutomobileNEW | HKEX - 175 | 17.560 (-1.18%) | EONW | 0.360 (-4.00%) | MMWW | 0.035 (+2.94%) |

| HKEXNEW | HKEX - 388 | 404.40 (+0.65%) | ENTW | 0.560 (+0.90%) | HRNW | 0.077 (0.00%) |

| HSBCNEW | HKEX - 5 | 116.10 (-1.02%) | ||||

| Petro China | HKEX - 857 | 8.150 (-1.09%) | OGIW | 3.030 (-2.57%) | SZLW | 0.042 (+2.44%) |

| PingAn | HKEX - 2318 | 65.400 (+2.59%) | RCDW | 2.270 (+12.94%) | WBAW | 0.030 (-14.29%) |

| Tencent | HKEX - 700 | 606.00 (-1.62%) | 9NPW | 7.100 (-2.47%) | 9VHW | 0.025 (+4.17%) |

Daily Leverage Certificates (DLCs) are designed to multiply the Daily Performance of an Underlying Asset by a factor, e.g. 3, 5 or 7 times. This means that for every $1 invested in a DLC, you can generate the same profit or loss as if you invested $3, $5 or $7 in the Underlying Asset directly!

Example: If the Underlying Asset goes up by 1% today, your 7X Long DLC would go up by 7%*. To put into dollar terms, say you buy a 7Xlong DLC at $5,000 today when the Underlying Asset is at 100. Tomorrow the Underlying Asset goes up to 101 (up by 1%). your DLC will be at $5,350 (up by 7%*). Selling it will earn you $350.

*Before costs & fees. Losses are leveraged as well as gains.

| DLC | CFD | Structured Warrants | |

|---|---|---|---|

| Listed on the exchange | Yes Every investor gets the same price | No Different providers show different prices | Yes. Same as DLC |

| Traded on margin | No Loss limited to invested capital | Yes Loss potentially more than invested capital | No |

| Time decay | No | No | Yes |

| Implied Volatility Impact | No | No | Yes |

To trade DLCs, you do not have to open accounts with us.

DLCs are listed on SGX like a stock, and they are also traded Like a stock! So if you have a stock broker account that can trade say Singtel share, you can use that broker account to trade DLC too! Unlike some other leveraged investment products, there is no margin requirement for DLCs.

DLCs as a leveraged product is classified as Specified Investment Product (SIP). You can check with your stock broker to see how to become SIP eligible, if you were not already.

Go to our website DLC.socgen.com and subscribe to our DLC daily newsletter!

Our DLC website provides with more detailed info about DLCs, such as live prices, price matrix, simulator etc. We also sent out daily newsletter to our members and host a weekly webcast on the website. Subscribe to our newsletter and stay tuned!