Daily Leverage Certificates

DLC Hotline: (65) 6226 2828

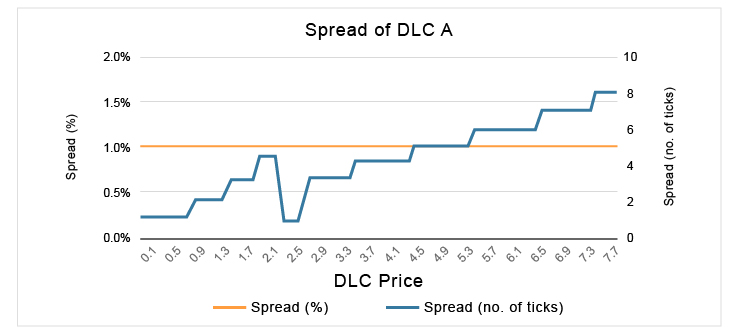

Spread of a DLC is determined based on the spread of the underlying asset plus relevant hedging cost. In general, for the same underlying asset, direction and leverage, this spread should be within a certain percentage no matter how much the DLC is.

Since the minimum tick size of a DLC is fixed at S$0.01 when it is above S$2. As a DLC increases in value, the spread in terms of dollar amount and ticks will also increase, while the spread in terms of percentage is kept within a certain range.

Assume the spread of DLC A is kept at 1%. As the DLC price increases from 0.1 to 5, its spread increases from 1 tick to 5 ticks, while the spread percentage is kept constant, as shown below:

Instead of number of ticks, investors should refer to percentage spread as the real cost of trading a DLC.

Currently, as most of the DLCs are priced less than S$ 2, investors should see most of the DLCs are within 1 to 2 ticks spread.

For detailed requirements of Designated Market Maker, investors can refer to the section of “Information Relating To The Designated Market Maker” section of the relevant Supplemental Listing Document.

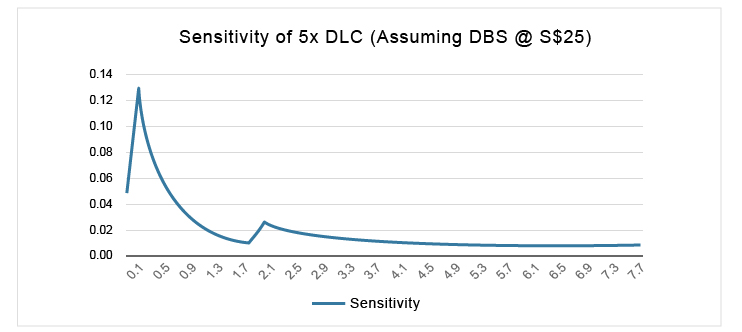

Sensitivity is the number of index points or dollar value movement of the underlying (in the underlying currency) that is equivalent to a theoretical 1 tick movement of the DLC. This value changes with DLC price and underlying price and is for reference only. The lower this value, the more sensitive the DLC is.

In general, as DLC price increases, its sensitivity also increases (sensitivity value decreases). Below example assumes DBS is at S$25 and the DLC is of 5x leverage.

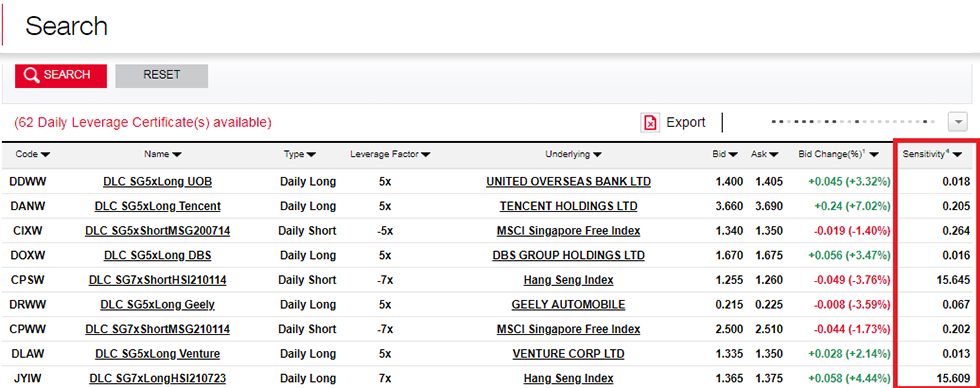

Investors can check the latest sensitivity of DLCs on https://dlc.socgen.com :

Reason to issue more than one DLC

Usually the reason to issue more than one product on the same underlying asset, direction and leverage is because the price sensitivity of existing products are getting lower due to their low unit price. The new products will provide investors with higher-sensitivity options, which is more favorable for short-term trading.

How to differentiate between the existing and new DLCs

For index DLCs, investors can differentiate between the existing and new DLCs by their expiry date as indicated in the counter name and by their stock code. The new products will have a longer dated expiry.

For single stock DLCs, apart from the difference in stock code, a letter ("A", "B" and so forth) will be added to the new product name for easy identification. For example, the name of the new 5x Short DLC on Tencent is "DLC SG5xShortTencent A". Investors can also go to SocGen's website https://dlc.socgen.com to check the difference in expiry date.

What are the differences between an “expensive” and a “cheap” DLC, if everything else (Underlying Asset, Direction and Leverage Factor) is the same?

These “cheap” DLCs might look attractive as investor can buy more shares with the same capital outlay.

In fact, the theoretical percentage movements between high and low priced DLCs are the same. (If a stock goes up by 2%, 5x Long DLC originally at 0.05 will go up to 0.055 while 5x Long DLC originally at 0.5 will go up to 0.55, both up by 10% before costs and fee; If a stock goes down by 2%, 5x Long DLC originally at 0.05 will go down to 0.045 while 5x Long DLC originally at 0.5 will go down to 0.45, both down by 10% before costs and fee)

Moreover, such low-price DLCs have the following disadvantages:

DLC is not a stock. Investors will not be better off holding more shares. Both high and low-priced DLCs have the same leverage factor and move by the same theoretical movement compared to the Underlying Asset, be it 2, 3, 5 or 7 times, Long or Short. However, investors should take note that there are some disadvantages in trading low-price DLCs.

Because of the above, when faced with DLCs with the same Underlying Asset, Direction and Leverage Factor, investors are advised to choose the higher-value DLC.

What will happen to the existing DLCs?

Despite the difference in price, sensitivity and expiry date, investors should note that both the existing and new products will move by the same theoretical percentage movement. For DLCs that are below certain value, DMM will keep the same market making quality on the bid side but may reduce the offer size.

The issue price of a DLC is arbitrary, i.e. it is decided by the issuer, which is similar to the mechanism of a stock or an ETF. For DLC, issuers determine the issue price that strikes a balance between tighter spread and higher sensitivity.

Because DLC issue price is arbitrary, for two DLCs of the same underlying asset, direction and leverage but of different prices, the lower-priced DLC should not be considered as more cost-effective than the higher-priced one. In fact, the higher-priced DLC will be more sensitive than the lower-priced DLC and hence will be a better product from short-term trading perspective.

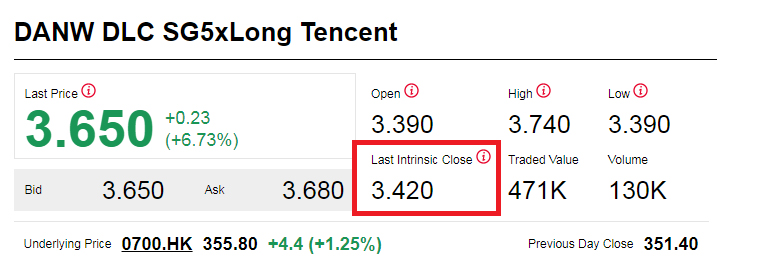

After a DLC is launched, its fair value is calculated according to the pricing formula, i.e. (daily percentage performance of the underlying asset x leverage) minus costs and fees applicable. Investors can check the latest intrinsic closing values on https://dlc.socgen.com, or can refer to the relevant Supplemental Listing Document published on the same website or SGX's website.

Apart from rounding and bid/ask which also impact the performance shown but to a lesser extent, the most common reason why investors might perceive that the DLC performance has deviated from expected leverage performance is due to a wrong reference price being used.

DLCs are designed around day-on-day performances, i.e. DLC performance should be compared to its value at underlying closing time the previous day. According to SGX's methodology of calculating daily percentage performance, SGX uses the last traded price of the DLC the previous day as the base (denominator). Since the time of the last trade on the DLC the previous day does not necessarily coincide with that of the underlying, there is a mismatch in what we are comparing. Less popular DLCs (with less trading to "refresh" the last price) usually show a bigger discrepancy.

To check if your DLC is providing the leverage performance as promised, you should compare the current bid price of the DLC against the "intrinsic close" value that is published daily on SG's website. This "intrinsic close" is the value of the DLC at the underlying closing time the previous day, and serves as an accurate reference price to calculate the expected leverage performance.

This is likely due to compounding effect.

DLC's leverage is fixed on a daily basis and is reset (back to the fixed leverage) at the end of each trading day. Technically, if a DLC is held for longer than a day, the return will be compounded every day, i.e. overall cumulative return would deviate from underlying asset cumulative performance multiplying by the fixed leverage. This is called compounding effect.

Compounding effect can be positive or negative, depending on the "path" of the underlying asset during the trading period.

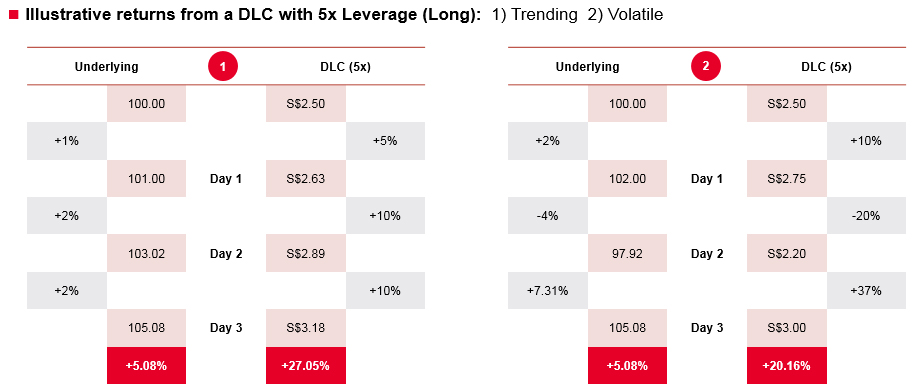

From the example above, the same overall cumulative performance of the underlying can result in a varying performance in the 5x DLC. In scenarios 1 and 2, the underlying reaches the same level of 105.08 after three days - however, on different "paths". The DLC performs differently in each scenario. In scenario 1, the underlying is on a clear upward trend, whereas in scenario 2 it is in a very volatile movement. In this case, the Daily Leverage Certificate performs better in scenario 1 than in scenario 2.

In general, compounding effect tends to be positive in trending market. For a Long DLC, when the market is trending up, Long DLC could deliver return more than the fixed leverage; when the market is trending down, Long DLC could lose value less than the fixed leverage.

In side-way or volatile market, DLCs may deliver leverage less than the fixed leverage, or may arrive at a loss when the underlying asset goes back to the same price after a volatile period.

The nature of compounding effect to a certain extent positions DLC as a trend trading product.

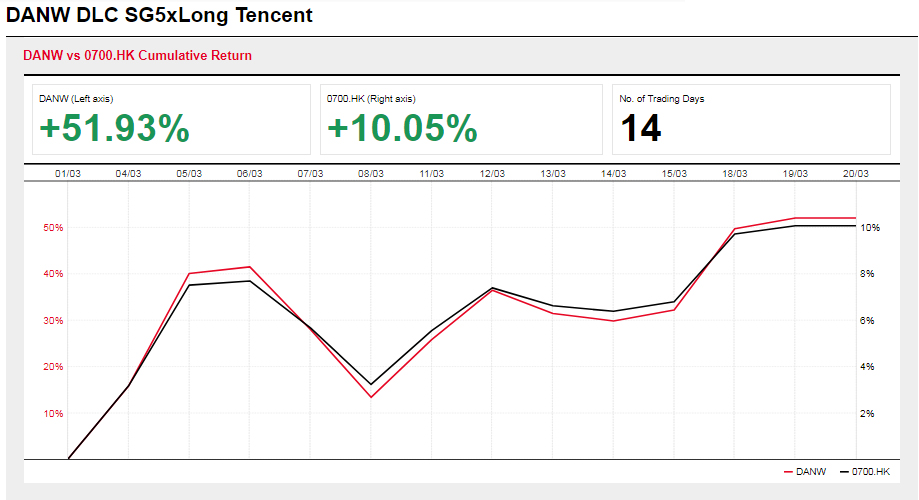

The "Cumulative Return" tool on https://dlc.socgen.com can help investors better understand compounding effect by selecting a historical period and compare the cumulative returns between underlying asset and DLC:

Investors can also refer to the section of "Illustration on how returns and losses can occur under different scenarios" in the relevant Supplemental Listing Document of the DLC for more information about compounding effect.

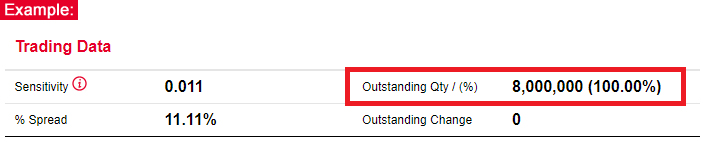

All DLCs have a fixed issue size when listed, which is the maximum quantity the Designated Market Maker (DMM) can sell to the public. In case DMM has sold all the issue size (i.e. when outstanding units % reaches 100%), it will no longer be able to provide an offer quote in the market.

Upon sold-out, DMM will continue to provide bid price according to the pricing formula. Investors who are holding existing units of DLCs will be able to unwind their positions as usual while not able to purchase extra positions from DMM.

Since DMM cannot provide continuous offer quote in the market, if the DLC continues to be in demand, market forces might drive up the DLC price to deviate from its fair value.

Issuer may apply for further issuance of the DLC to resume continuous market making for both bid and offer.

Expiry Date of a DLC is usually 3 years from its launch date.

Last Trading Date usually falls on the date which is 5 business days before Expiry Date. Investors will not be able to trade the DLCs after Last Trading Date.

DLCs will be delisted after Expiry Date. If investors hold certain DLC until expiry, the DLC will be cash settled at its fair intrinsic value determined on Valuation Date, which is usually one Business Day before Expiry Date.

The cash settlement will be made no later than 5 Business Days after Expiry Date. Investors may refer to the Termsheet and Supplementary Listing Document of the DLCs for the exact dates.

Societe Generale does not charge any expiry processing fee, however other external parties such as SGX or Brokers may charge additional fees to be borne by investors.

Prior to expiry of a DLC, issuers may issue DLCs with a longer expiry for investors to continue expressing the same view.

Example

Assuming for a certain DLC

Last Trading Date = 6 July

Valuation Date = 13 July

Expiry Date = 14 July

Settlement Date no later than 21 July

Intrinsic Close on 6 July = SGD 0.2

Intrinsic Close on 13 July = SGD 0.25

Investors will not be able to trade the DLC after 6 July (Last Trading Date), and the value of this DLC will keep moving with the Underlying Asset according to the formula until 13 July (Valuation Date). In other words, investors who do not sell the DLCs on or before Last Trading Date will bear the market risk from Last Trading Date to Valuation Date. The DLC will cease to exist after 14 July (Expiry Date), and the cash settlement (if any) will be made no later than 21 July (last Settlement Date). In this example, investors will get back SGD 0.25 per unit of DLC (being intrinsic value determined on Valuation Date).

The bid and ask quoting usually refills every few seconds. Investors can either place the entire order in the market or trade in tranches. There is no guarantee that all the tranches will be settled at the same price, as the quoting moves continuously with the underlying price.

Taking DBS stock as an example. Assuming DBS is at S$ 25.5 today at close and tomorrow is ex-dividend day and DBS is paying out S$ 0.5 of dividend. If tomorrow DBS opens at S$ 25, both Long DLC and Short DLC will be unchanged in value (before costs and fees). If DBS opens at S$ 25.5, it will be seen as up by 2%, i.e. 5x Long DLC will be up by 10% and 5x Short DLC will be down by 10% (before costs and fees).

Investors can refer to "Leverage Strategy Formula" and "Examples and illustrations of adjustments due to certain corporate actions" in the relevant Supplemental Listing Document of the DLCs for more details.

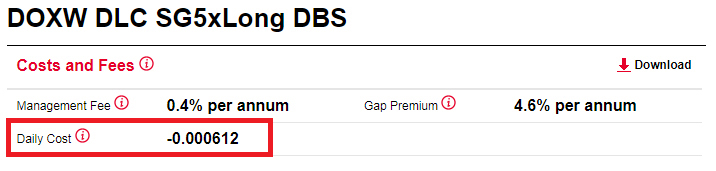

Investors holding their positions overnight will incur leverage and hedging costs and fees which consist of the Management Fee, Funding Costs, Stock Borrowing Costs (for Short Certificates only), Rebalancing Costs (if applicable) and Gap Premium, which are calculated daily and applied to the value of the product. The costs and fees level will be published on the website at http://dlc.socgen.com and updated daily.

Usually, the daily cost & fee is accumulated is less than a minimum tick.

For the full calculation of the cost and fees, investors can refer to the "Leverage Strategy Formula" section in the relevant Supplemental Listing Documents of the DLCs.

When the underlying Index or Stock is halted or suspended from trading, the relevant Index or Stock DLCs will also be halted or suspended from trading. Trading of the relevant DLCs will resume when the underlying Index or Stock resumes trading.

Upon resumption of trading, the reference price of the affected DLCs will generally be determined based on the latest closing price of the underlying Index or Stock on the relevant business day before the date it was halted or suspended from trading.

For the price data of the underlying US stock during Asian hours, investors can reference such information from 1) SG DLC website under the respective individual Terms page of the US Stock DLCs or 2) from several brokers in Singapore who offer relevant price data of US stock trading during Asian hours.

For more details on the DLCs with US underlying indices and stocks including how the performance works and the airbag mechanism, investors can refer to the “US Market” tab on this website or click here to read more.

There are a number of possible situations for a DLC to be early terminated. Below are some (non-exhaustive) examples:

It is possible for a DLC to lose 100% of its value due to a sharp overnight or intraday rise/fall of the underlying stock. For example, for a 5x Long DLC, the DLC would lose its entire value should the underlying asset fall by 20% or more overnight or within the 15 minutes Observation Period intraday compared to the reference level (the reference price being: (1) if air bag has not been previously triggered on the same day, the previous closing level of the underlying asset, or (2) if one or more air bag have been previously triggered on the same day, the latest New Observed Level). In such situations, the Issuer will terminate the DLC early and no payment will be repaid by the Issuer to holder.

There could be situations where the Designated Market Maker (DMM) may face a Hedging Disruption Event. This occurs when the DMM, following commercially reasonable efforts, is not in the position (i) to enter, re-enter, replace, maintain, liquidate, acquire or dispose of any Hedge Positions or (ii) to freely realize, recover, receive, repatriate, remit, regain or transfer the proceeds of any Hedge Position. When this happens, the Issuer may determine that a Hedging Disruption Event has occurred and may terminate the affected DLC early.

One example of a Hedging Disruption Event is where the required daily hedging transaction has grown to a large size relative to the daily traded value of the underlying stock within a short span of time. To illustrate:

A DLC may be terminated early if a Regulatory Event has occurred due to changes in law beyond the Issuer’s control.

One such example is where government sanctions or other changes in law affect the underlying stock of the DLC, and would result in the Issuer being in breach of certain regulations or laws or being non-compliant with its internal group policies or impacted adversely in a material way, should it continue to perform its obligations under the DLC or hedging of its obligations under the DLCs. In this case, the DLCs may be terminated early.

What happens if my DLC is early terminated?

Investors may refer to the Supplemental Listing Document of each DLC to find out more on the terms and conditions relating to an early termination.

Investors can call SG's DLC hotline - (65) 6226 2828 or email to [email protected].

This document has not been reviewed by the Monetary Authority of Singapore ("MAS"). This document is distributed by Societe Generale. If you wish to discuss this document, you should do so with your financial advisor, authorised broker or with MAS licensed representatives of Societe Generale, Singapore Branch. This document does not constitute or form part of any offer, or invitation, to subscribe for or to sell, or solicitation of any offer to subscribe for or to purchase, any certificates on indices/equities (the "Certificates" or "Daily Leverage Certificates"), warrants or other securities. Nothing herein should be considered as investment or financial advice or any form of recommendation to purchase or sell the Certificates/Daily Leverage Certificates, warrants or other securities mentioned. Information herein is intended as general information only and does not take into account the specific investment objectives, financial situation and the particular needs of any particular person. The price of Certificates/Daily Leverage Certificates, warrants or other securities and/or the price of the underlying asset may fall in value as rapidly as it may rise and holders may sustain a total loss of their investment. Investments in the Certificates/Daily Leverage Certificates, warrants or other securities carry risks. Any past performance of the Certificates/Daily Leverage Certificates, warrants or other securities, or past performance of an underlying asset, is not indicative of future performance. This document does not constitute a full disclosure of the risks involved. Members of the Societe Generale group and/or its connected persons may take proprietary positions and may have long or short positions or other interests in the Certificates/Daily Leverage Certificates, warrants or other securities and may purchase and/or sell the Certificates/Daily Leverage Certificates, warrants/ or other securities at any time in the open market or otherwise, in each case whether as principal, agent or market maker.

The terms and conditions of any Certificates/Daily Leverage Certificates, warrants or other securities must be read in conjunction with the base listing documents for those Certificates/Daily Leverage Certificates, warrants or other securities and the relevant supplemental listing document. Investors should therefore ensure that they understand the nature of the Certificates/Daily Leverage Certificates, warrants or other securities and carefully study the risk factors set out in the base listing document and the relevant supplemental listing documents and, where necessary, seek professional advice before investors invest in the Certificates/Daily Leverage Certificates, warrants or other securities. Copies of the base listing document, which contains financial and other information relating to the Issuer and any addenda thereto and the relevant supplemental listing documents, which contain details of the Certificates/Daily Leverage Certificates, warrants or other securities, can be obtained from the Allen & Gledhill LLP at One Marina Boulevard #28-00, Singapore 018989. Investors should read these documents in their entirety before agreeing to invest in the Certificates/Daily Leverage Certificates, warrants or other securities.

This is a structured product which involves derivatives and investors should not invest without fully understanding and being willing to assume all risks associated with the Certificates/Daily Leverage Certificates, warrants or other securities. Investors should ensure they understand the risks, nature, terms and conditions of the Certificates/Daily Leverage Certificates, warrants or other securities and consult their own legal, financial, tax and professional advisers regarding the suitability and risks before committing to any investment.

Investors risk the loss of part or all of their investment. Investment in the Certificates/Daily Leverage Certificates, warrants or other securities involves significant levels of risks and the Certificates/Daily Leverage Certificates, warrants or other securities should only be purchased by investors who are knowledgeable in investment matters or who have obtained appropriate investment advice.

Societe Generale and its affiliates (the "SG Group") act in different capacities in relation to the issue of the Certificates/Daily Leverage Certificates, warrants or other securities. SG Issuer is the issuer of the Certificates/Daily Leverage Certificates, warrants or other securities (the "Issuer"), Societe Generale acts as designated market maker for the Certificates/Daily Leverage Certificates, warrants or other securities. Societe Generale, Singapore Branch is also authorized to distribute and market the Certificates/Daily Leverage Certificates, warrants or other securities] to its customers. For the avoidance of doubt and as an independent stipulation, investors agree that by purchasing the Certificates/Daily Leverage Certificates, warrants or other securities, the SG Group may provide different services and/or perform different roles in relation to the issuance, offer and/or dealing in the Certificates/Daily Leverage Certificates, warrants or other securities. The investor acknowledges and agrees that the provision of such services or the undertaking of such roles may not always be consistent with the interests of the issuer and/or the investors. The investor agrees that subject to mandatory applicable law which the SG Group cannot derogate from, no implied duties or obligations shall be imposed on SG Group to the investor under the Certificates/Daily Leverage Certificates, warrants or other securities, and in connection with or as a result of the investor's subscription or purchase of the Certificates/Daily Leverage Certificates, warrants or other securities.

The Issuer or Societe Generale may have a position or a material interest in any underlying asset.

The Issuer, Societe Generale or any of their affiliates may engage in transactions involving the underlying asset for their own account for business reasons or in connection with hedging of the obligation under this Certificates/Daily Leverage Certificates, warrant or other securities. Conflicts of interest may arise as a result of such transactions within the SG Group and with the interest of investors. The Issuer, Societe Generale and their affiliates are not required to consider any investors' interests in connection with entering into any of the above mentioned transactions.

The Issuer, Societe Generale and their affiliates may receive benefits and/or profits as a result of its multiple roles as designated market maker and/or distributor (whether in the nature of a fiduciary, similar or additional duty or relationship or otherwise) and fully consents to the retention of such benefits and/or profits for their own account. Each investor acknowledges and agrees that none of the Issuer, Societe Generale and their affiliates is obliged to notify, and is liable to account to, an investor or any other person for (and each investor or such other person shall not be entitled to ask for disclosure of the fact or the amount of, any fees resulting from any of the aforementioned roles, other than is already disclosed in the offering documents for the Certificates/Daily Leverage Certificates, warrants or other securities. Each investor agrees that the investor will have no claim against the Issuer, Societe Generale and their affiliates for, and the investor consents to the receipt, acceptance and retention by the Issuer, Societe Generale and their affiliates of, such fees arising from any such multiple roles.

Societe Generale does not make any warranty, express or implied, as to the accuracy or completeness of the information contained herein. No responsibility or liability is accepted by Societe Generale for any inaccuracies, omissions, mistakes or errors of Societe Generale in the computation of the cash settlement amount or for any economic or other loss which may be directly or indirectly sustained by any broker or holder of the Certificates/Daily Leverage Certificates, warrants or other securities or any other person dealing with the Certificates/Daily Leverage Certificates, warrants or other securities as a result thereof and no claims, actions or legal proceedings may be brought against Societe Generale in connection with the Certificates/Daily Leverage Certificates, warrants or other securities in any manner whatsoever by any broker, holder or other person dealing with the Certificates/Daily Leverage Certificates, warrants or other securities. Any broker, holder or other person dealing with the Certificates/Daily Leverage Certificates, warrants or other securities does so therefore in full knowledge of this disclaimer and can place no reliance whatsoever on Societe Generale. For the avoidance of doubt, this disclaimer does not create any contractual or quasi-contractual relationship between any broker, holder or other person and Societe Generale and must not be construed to have created such relationship.

The Certificates/Daily Leverage Certificates, warrants or other securities are not deposits placed with Societe Generale.