Daily Leverage Certificates

DLC Hotline: (65) 6226 2828

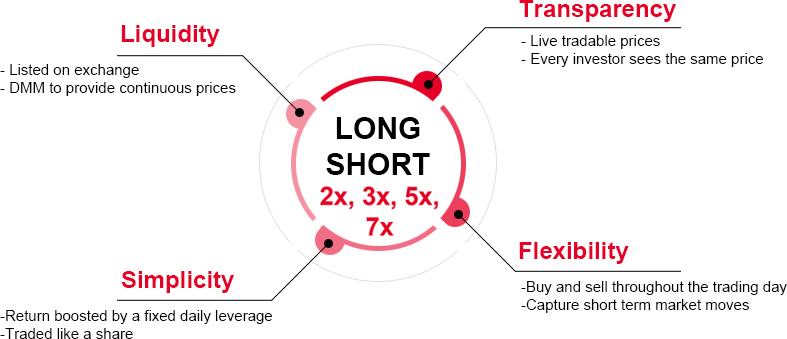

Daily Leverage Certificates (DLC) are exchange-traded financial products that enable investors to take a leveraged exposure to an Underlying Asset, such as an equity index or a single stock (Full list of DLCs). Daily Leverage Certificates replicate the performance of an Underlying Asset versus its previous day closing level, with a fixed leverage factor.

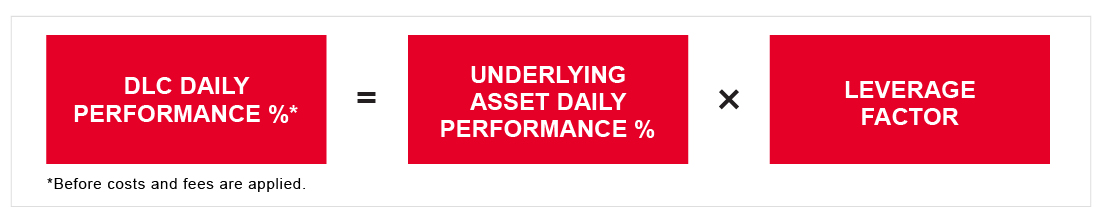

The leverage effect means that any movements in the Underlying Asset are amplified. Daily Leverage Certificates will leverage the investment exposure by a fixed amount, e.g. 2, 3, 5 or 7 times. Therefore, the daily percentage return of Daily Leverage Certificates will be equal to the daily percentage return of the Underlying Asset multiplied by the fixed leverage factor, before costs and fees.

Please note that investors should not refer to the last traded price in the previous trading day as the reference price to determine DLC daily performance. This is because the last trade done in the previous day may not be made exactly at market close of the underlying asset, i.e. last traded price in the previous day does not reflect the market movement between the last traded time and the market close. Investors should refer to Intrinsic Close published on Societe Generale’s DLC website as reference price to determine DLC daily percentage performance.

Intrinsic Close is the value computed with reference to the valuation formula of the Certificates. More information on the valuation formula of the Certificates can be found in the relevant supplemental listing documents.

Each DLC is a separate trading counter on the exchange, with a separate counter name, trading code and price. The price of a DLC can be different from its Underlying Asset and is decided by the Issuer on the initial issue date. After a DLC is listed, its performance will follow the pre-determined relationship as described above.

There are two types of Daily Leverage Certificates - Daily Long and Daily Short which enable investors to take a long or short exposure to an Underlying Asset.

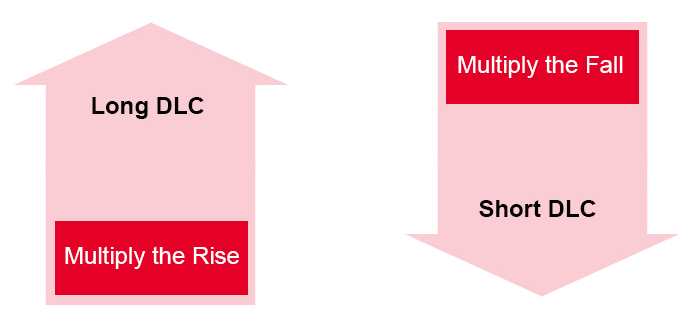

Long DLCs allow you to generate leveraged gains when the Underlying Asset goes up. On the other hand, Short DLCs increase in value when the Underlying Asset goes down, allowing investors to achieve positive and leveraged gains during market downturn.

Conversely, you will sustain leveraged losses when the Underlying Asset goes down for Long DLCs, or when the Underlying Asset goes up for Short DLCs.

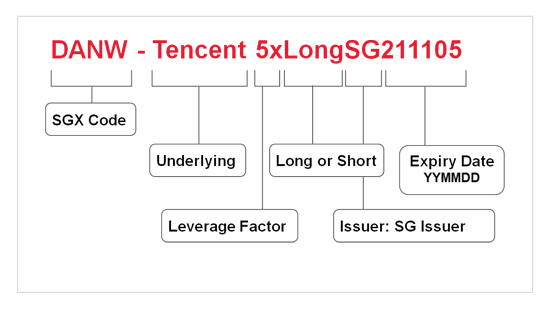

The full name of a DLC already tells a lot of information. Below examples show how to read a DLC name.

If there are more than one DLC with the same terms, DLCs that are launched subsequently are supplemented with an ‘A’, ‘B’, ‘C’ and so forth after expiry date.

What happens if I hold a DLC until expiry?

If you hold a DLC until expiry, the DLC will be settled at the fair value based on the pricing formula. If a 5x DLC is worth S$2 one day before expiry, and if the Underlying Stock remains unchanged on the expiry date, then the settlement price of the DLC will be at S$2.

The below examples illustrate how to calculate profit and loss investing in a DLC, before costs and fees are factored in.

5x Long DBS

5x Long DBS is at S$2. Buy 500 shares of this DLC with S$1000 when DBS is at S$25

DBS goes up from S$25 to S$25.5, i.e. up 2%

5x Long DBS will go up from S$2 to S$2.2, i.e. up by 2% x 5 = 10% compared to the previous day close

If instead DBS goes down from S$25 to S$24.5, i.e. down 2%

5x Short Tencent

5x Short Tencent is at S$1. Buy 1,000 shares of this DLC with S$1,000 when Tencent is at HK$300

Tencent goes up from HK$300 to HK$309, i.e. up by 3%

5x Short DLC will go down from S$1 to $0.85, i.e. down by 3% x 5 = 15% compared to the previous day close (assume exchange rate between HKD and SGD remain unchanged)

If instead Tencent goes down from HK$300 to HK$291, i.e. down by 3%

5x Short Tencent will go up from S$1 to S$1.15, up by 15% compared the previous day close (assume exchange rate between HKD and SGD remain unchanged)

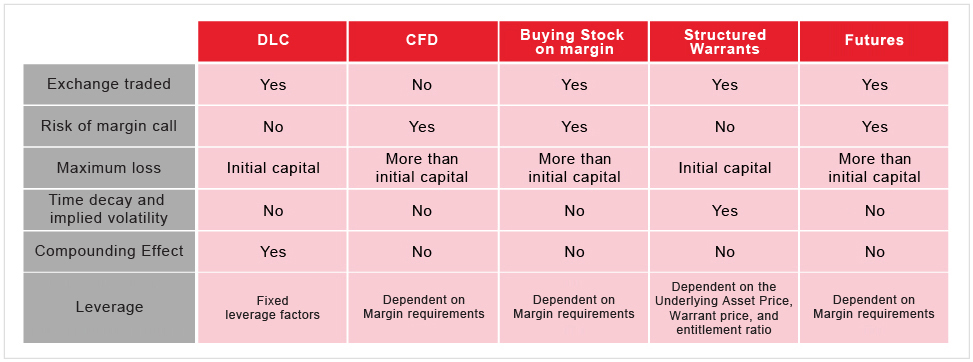

CFDs have been introduced in the market for a much longer time and are therefore more mature in terms of offerings. There are different asset classes available in CFDs, while DLCs currently are available on certain indices and single stocks only.

Because DLC are listed on the cash market of the SGX, there is no risk of margin call.

The other difference between DLC and CFD is that the trading commission for CFDs are charged based on the total contract size (or total exposure). But for DLCs the trading commission is charged based on the amount of the DLCs, which is a fraction of the total exposure. For the same amount of exposure, if the trading commission rate is the same between DLC and CFD, the total trading commission charged on the DLC will be less.

Similar to the above, trading commission is charged on the entire contract value when investors buy stocks on margin. There is also risk of margin call.

Structured Warrants are options in nature. The time decay rate increases as the Structured Warrant is closer to maturity. DLCs, on the other hand, are not options and hence do not have an exponential time decay (for holding cost of DLCs, please see “Costs & Fees”).

The other difference is that implied volatility does not have an impact on DLC prices.

Futures are listed derivative financial contracts that obligate the parties to transact an asset at a predetermined future date and price.

Comparison with DLCs:

Futures usually have larger minimum contract size. They also have margin maintenance requirements.

Investors may have to allocate more funds to return the margin to the initial margin level when there is an unrealised loss in the position.

DLCs can be traded on per board lot basis (equivalent to 100 certificates). They have no margin maintenance requirements, so with less capital being locked up, investors would have more flexibility regarding their asset allocation. The maximum loss is limited to the initial invested capital.

Let’s take a look at the example below:

On 4 February, 2021, one contract of the HSI Futures expiring on Dec 2023 has initial margin of HKD$105,070 (~SGD$18,000) for a Futures contract providing ~13x leverage.

Maximum loss could be larger than initial invested capital upon unfavourable market movement.

On 4 February, 2021, one board lot of CUUW HSI 7xLongSG231215 opens at 4.200.

The required capital for entering the trade is SGD$420, which is also the maximum loss for the DLC providing 7x leverage.

Compared to other leveraged products, the features specific to DLC is compounding effect and Air Bag Mechanism. (see “Compounding Effect” and “Air Bag Mechanism” for more detail).

Daily Leverage Certificates are designed around the Daily Performance of their Underlying Asset. They apply a fixed level of leverage which makes it easier to determine price movements during a single Trading Day. However, this does not mean that DLCs are only for day trading purpose.

Investors should note that if they hold DLCs for longer than one day, the return could outperform or underperform the leverage factor embedded within the product.

This is because the exposure of a DLC is reset at the end of each Trading Day back to its fixed leverage factor.

When markets open the next day, the performances of the Underlying Asset and the DLC will be measured from the closing levels recorded the previous Trading Day.

What this means, in practice, is the performance each day is locked in, and any subsequent returns are based on what was achieved the day before. This is a process referred to as 'compounding'.

The compounding effect can positively enhance returns in trending markets (upward or downward) whilst negatively impacting returns when the markets are more volatile or trend sideways for long periods. The effect of this compounding is further amplified as daily returns are leveraged.

Investors can check historical performances of DLCs vs Underling Asset (and hence the level of compounding effect) via here.

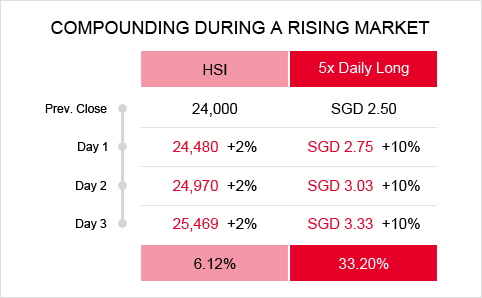

The following 3 scenarios illustrate how Daily Longs & Daily Shorts perform in various market scenarios and demonstrate both the positive and negative effects of compounding. We will make the assumption that investors purchase 5x Daily Long or 5x Daily Short at SGD2.50 per unit and the Underlying closed at a level of 24,000 on the previous trading day.

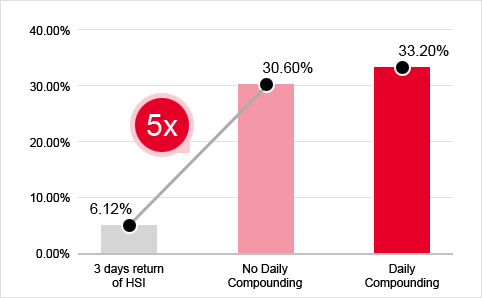

In trending markets with low volatility, the performance of the Daily Leverage Certificate for a period longer than a day may exceed the return of the Underlying Asset, multiplied by the stated exposure level.

The non-compounded, leveraged return is for illustrative purposes and does not relate to any specific product. The calculation below is before costs and fees are factored in.

Trending Up

This example explains how consecutive days of positive returns will lead to 5x Daily Long returning more than 5 times the overall performance of the Underlying Asset.

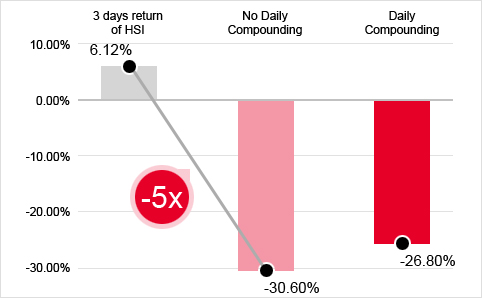

The Underlying Asset has increased a total of 6.12% over the 3-day period but 5x Daily Long would have increased 33.20%, which is 5.42 times the performance of the index (33.20/6.12). This is because each day the return is applied to a progressively larger amount. If daily compounding was not applied, 5x Daily Long would have only increased by 30.60% (6.12%x5) as the Underlying Asset is assumed to have an initial constant increase of 6.12%.

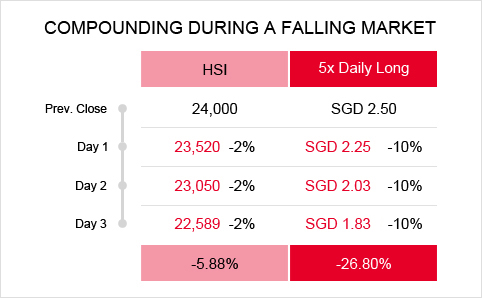

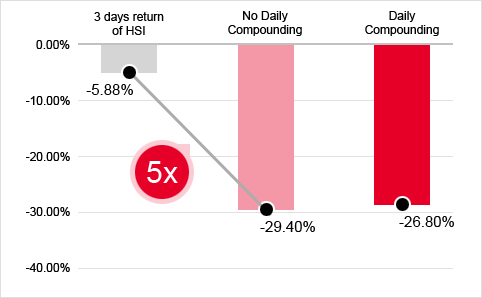

Trending Down

This example explains how consecutive days of negative returns will lead to 5x Daily Long falling less than 5 times the overall performance of the Underlying Asset.

The Underlying Asset has fallen a total of 5.88% over the 3-day period but 5x Daily Long has fallen 26.80%, which is only 4.56 times the performance of the index (26.80/5.88). This is because each day the loss is taken from a progressively smaller amount. For example, on day 1, the 10% loss to 5x Daily Long is applied to SGD2.50 and creates a SGD0.25 loss. However, by day 2 the 10% loss is applied to SGD2.25, creating a loss of SGD0.22. If compounding was not applied, the product would have lost 29.40% (5.88%x5) as the Underlying Asset is assumed to have an initial constant decrease of 5.88%.

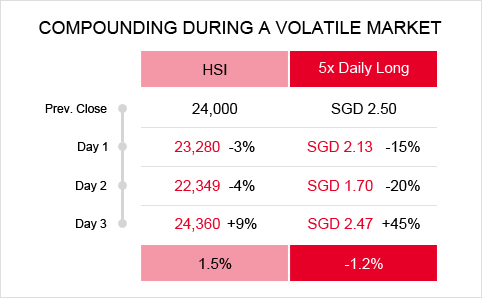

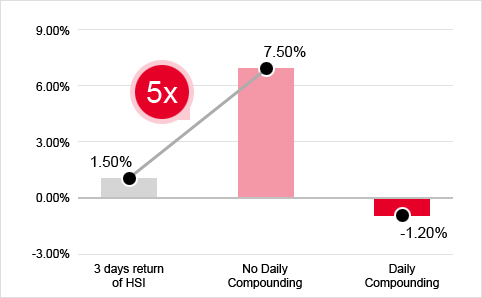

Volatile Markets

The downside of compounded returns comes from volatile markets where prices are changing on an erratic basis from one day to another. The example below shows that 5x Daily Long falls 15% on day 1 and 20% on day 2, before rising by 45% on day 3. The important point to note here is that the 45% rise on day 3 only takes 5x Daily Long back to a value of SGD2.47. This is because 5x Daily Long was only valued at SGD1.70 when it began to recover on Day 3. As such, the 45% gain only amounted to SGD0.77 (SGD1.70x 45%). The overall loss over the 3 days is 1.2%. There would have been a gain of 7.50% (1.5% x5) without compounding. In this case, the product recorded a loss even though the Underlying Asset has moved in the same direction on a daily basis.

This highlights a key risk of the DLCs; the more the DLCs fall, the harder it is for them to recover because any subsequent gain in percentage is applied to a lower value of the Daily Leverage Certificates due to the effect of compounding. This is the reason these products are not designed to be held for long periods.

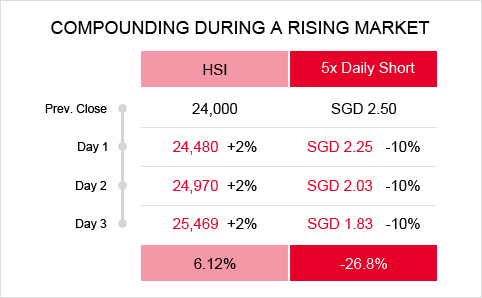

Trending Up

This example explains how consecutive days of positive returns will lead to 5x Daily Short falling less than 5 times the overall performance of the Underlying Asset.

The Underlying Asset has increased a total of 6.12% over the 3-day period but 5x Daily Short has fallen 26.80%, which is 4.38 times the inverse performance of the index (26.80/6.12). This is because each day the loss is applied to a progressively smaller amount. If compounding was not applied, 5x Daily Short would have decreased by 30.60% (6.12%x5) as the Underlying Asset is assumed to have an initial constant increase of 6.12%.

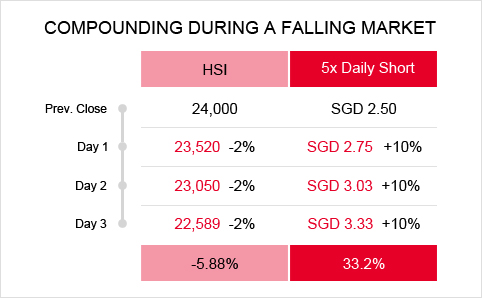

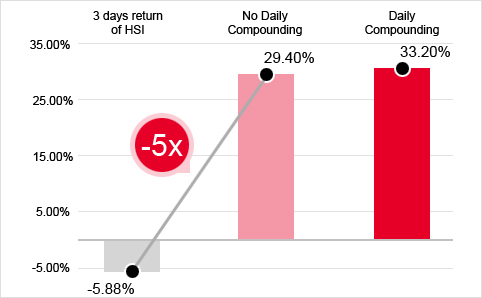

Trending Down

This example explains how consecutive days of negative returns will lead to 5x Daily Short returning more than 5 times the overall performance of the Underlying Asset. In this example, the Underlying Asset has fallen a total of 5.88% over the 3-day period but 5x Daily Short has increased 33.20%, which is 5.65 times the performance of the index (33.20/5.88). This is because each day the return is taken from a progressively larger amount. If compounding was not applied, the product would have increased 29.40% (5.88% x5) as the Underlying Asset is assumed to have an initial constant decrease of 5.88%.

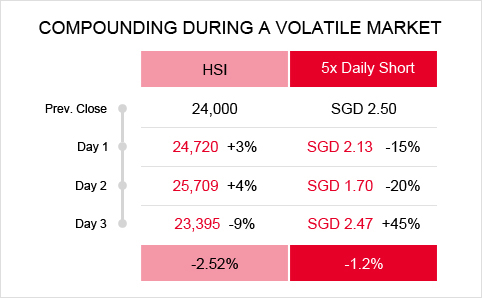

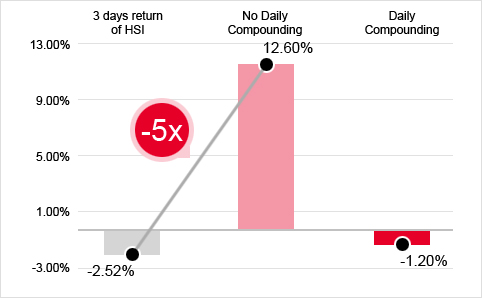

Volatile Markets

The below example shows that 5x Daily Short fall 15% on day 1 and 20% on day 2, before rising 45% on day 3. The important point to note here is that the 45% fall on day 3 only takes 5x Daily Short back to a value of SGD2.47. This is because 5x Daily Short was only valued at SGD1.70 when it began to recover on Day 3. As such, the 45% gain only amounted to SGD0.77 (SGD1.70x45%). The overall loss over the 3-day is 1.2%. There would have been a gain of 12.60% (2.52%x5) without compounding. In this case, the product recorded a loss even though the Underlying Asset has moved in the same direction on a daily basis.

This highlights a key risk of the Daily Leverage Certificates; the more the Daily Leverage Certificates fall, the harder for them to recover because any subsequent gain in percentage is applied to a lower value of the Daily Leverage Certificates due to the effect of compounding. This is the reason these products are not designed to be held for long periods.

The Air Bag Mechanism is a mechanism that is built into the Daily Leverage Certificates. It is designed to reduce the actual exposure of the Daily Leverage Certificates to changes in the Underlying Asset in case of significant adverse movement in the Underlying Asset during the day.

| Underlying Type | Product | Airbag Trigger |

|---|---|---|

| Equity Index | 2x Daily Long | -20% |

| Equity Index | 2x Daily Short | +20% |

| Equity Index | 3x Daily Long | -20% |

| Equity Index | 3x Daily Short | +20% |

| Equity Index | 5x Daily Long | -10% |

| Equity Index | 5x Daily Short | +10% |

| Equity Index | 7x Daily Long | -10% |

| Equity Index | 7x Daily Short | +10% |

| Single Stock | 3x Daily Long | -20% |

| Single Stock | 3x Daily Short | +20% |

| Single Stock | 5x Daily Long | -15% |

| Single Stock | 5x Daily Short | +15% |

If the Underlying Asset is an Equity Index, for a 3 times Daily Leverage Certificates, the Air Bag will be triggered when the Underlying Asset moves against the Daily Leverage Certificates by 20%, and for 5 times Daily Leverage Certificates by 10% compared to previous close, or previous New Observed Level (as defined below) if an Air Bag has already occurred on the same trading day.

If the Underlying Asset is a Single Stock, for a 5 times Daily Leverage Certificates, the Air Bag will be triggered when the Underlying Asset moves against the Daily Leverage Certificates by 15% compared to previous close, or previous New Observed Price if an Air Bag has already occurred on the same trading day.

Investors should note that the airbag can only be triggered during trading hours of the relevant stock exchange for the Index or Stock. For example, the airbag for a DLC on Hang Seng Index and DLC on S&P500 Index can only be triggered during HKEx trading hours and US trading hours respectively when the underlying index is quoted. For details on the airbag mechanism relating to DLCs with US underlying indices, read more here.

Air Bag will NOT be triggered on the DLC that is in line with the market direction, i.e. on Long DLC when Underlying Asset is going up, or Short DLC when Underlying Asset is going down.

Investors should note however that the Air Bag Mechanism will also maintain a reduced exposure to the Underlying Asset even if the Underlying Asset starts to move in favor of the DLCs after the Air Bag Mechanism has been triggered, thereby reducing its ability to recover losses for investors.

There is no guarantee the Air Bag Mechanism will prevent investors from losing the entire value of their investment if the underlying continues to move beyond the airbag trigger.

For a 5 times DLC, In the case of a big overnight drop of more than 20% (or 20% drop within the 15-minute observation period), the DLC would also result in a total loss. (Similarly, 15% for 7x and 34% for 3x)

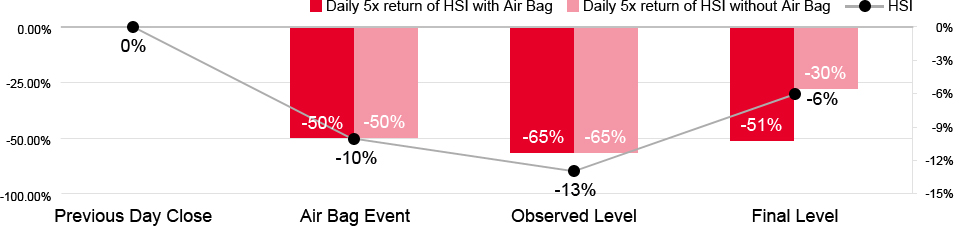

How it works in practice

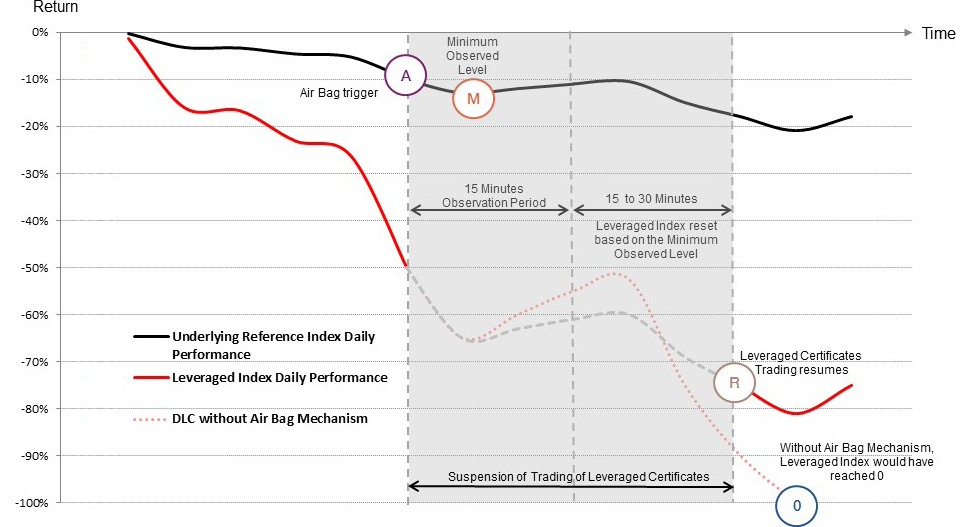

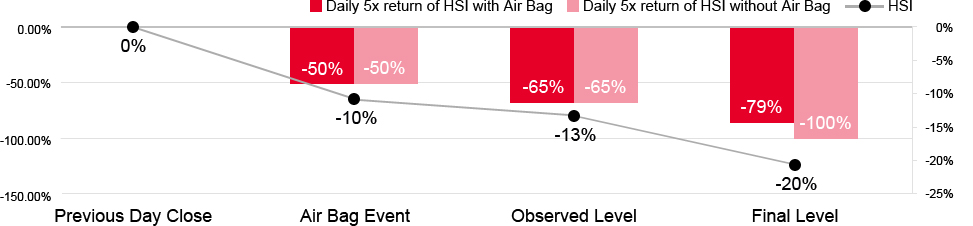

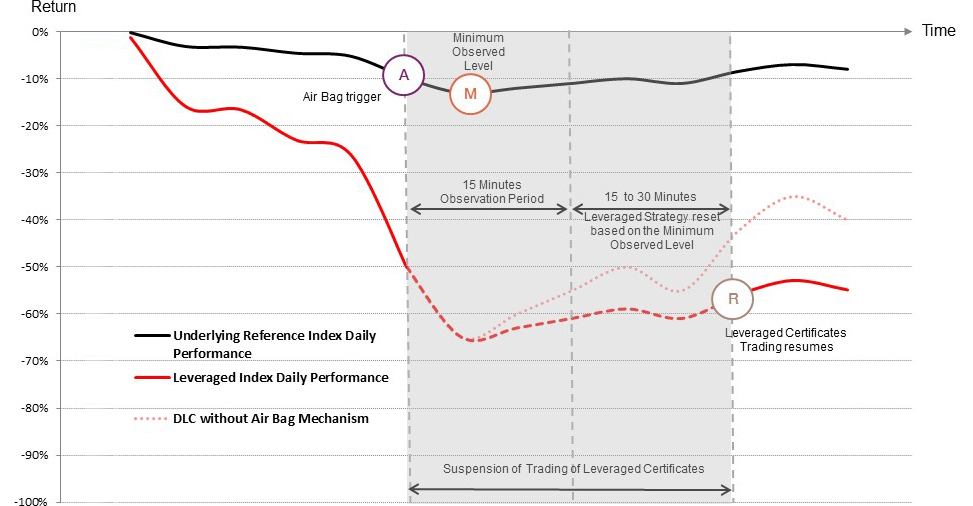

The Air Bag Mechanism is triggered when the Underlying Asset reaches the stated Airbag Trigger Level (denoted by "A" in the next diagram). When the Air Bag Mechanism is triggered, the trading of the Daily Leverage Certificates is suspended, and a 15-minute observation period begins.

During the 15-minute observation period the lowest level (for a Daily Long), or highest level (for a Daily Short) of the Underlying Asset is recorded, this level is termed the new observed level (denoted by "M" in the next diagram).

Resumption in trading of the Daily Leverage Certificates (denoted by "R" in the next diagram) happens 30 to 45 minutes after the Air Bag Mechanism has been triggered and the leverage of the Daily Leverage Certificates is subsequently applied to the performance of the Underlying Asset computed from the observed level instead of the last closing level.

The Air Bag Mechanism can only be triggered when the underlying market is open, which may not be at the same time as when the DLC is trading.

The Air Bag Mechanism can be triggered more than once per day, and the new trigger level will be based on the new observed level.

The figures used in the above example are given for purely indicative purposes, the objective being to describe the Air Bag Mechanism of the product. For the purpose of these illustrations cost and fees are not taken into account.

However, if the markets were then to bounce back, the Air Bag Mechanism would actually work against the investors, as it reduces the ability of the Daily Leverage Certificates to recover. This is due to the fact that the subsequent positive daily performance is now applied on a lower value (observed level) of the Underlying Asset.

The figures used in the above example are given for purely indicative purposes, the objective being to describe the Air Bag Mechanism of the product. For the purpose of these illustrations cost and fees are not taken into account.

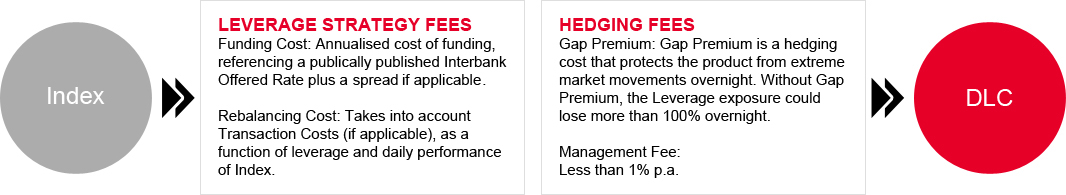

The examples in the previous sections are simplified without costs and fees for illustration. In the actual trading of the Daily Leverage Certificates, on top of rounding differences, costs and fees are factored in such that the daily performance of the Daily Leverage Certificates is not exactly equal to the leverage factor multiplied by the daily performance of the Underlying Asset.

When the investors trade intra-day (buying and selling the Daily Leverage Certificates on the same Trading Day), the costs are the brokerage fees, trading fees and Bid/Ask Spread from trading which are typically the same as trading stocks on the relevant exchange. The leverage and hedging costs and fees will only apply when the Daily Leverage Certificates are held overnight.

Costs and fees are transparent and can be computed with published data using the formula. The specific costs and fees for each product can be found on the individual product page on http://dlc.socgen.com or the relevant listing documents.

| Trading intra-day | Held overnight | |

|---|---|---|

| Brokerage Fee | ||

| Bid/Ask Spread | ||

| Funding Cost* | ||

| Stock Borrowing Costs* (for Short DLC only) | ||

| Rebalancing Costs* | ||

| Gap Premium | ||

| Management Fee |

*Embedded in the Leveraged exposure

Stamp or other charges may be applicable in accordance with the laws and practices of the courts where the Daily Leverage Certificates are traded.

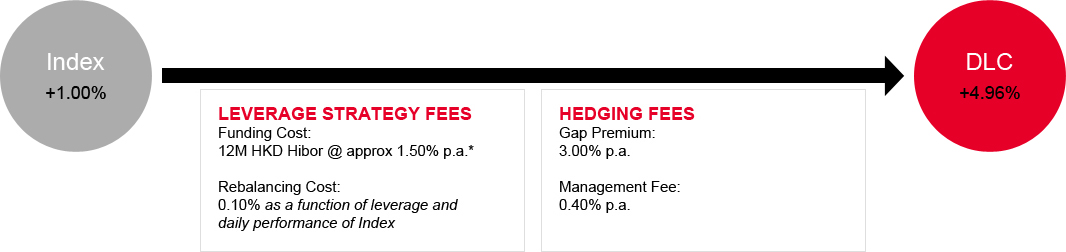

There are costs and fees that are linked to the leverage exposure:

An illustration of costs and fees with a 5x Daily Long on HSI

In the example above, the costs and fees per day are approximately 4 basis points of the Daily Leverage Certificates' value (SGD 2.5 X 0.04%= SGD 0.001). This is less than the original minimum ticker size (SGD0.01) when the Daily Leverage Certificates are issued at SGD 2.50.

*as of 29 June 2017

A Designated Market maker (DMM, Société Générale in this case) will contribute live tradable prices and intra-day liquidity for investors to buy and sell via brokers during the following SGX market hours:

DLCs on HSI / HSCEI / HSTECH / HK stocks: 09:30am to 12:00pm; 01:00pm to 04:00pm

DLCs on Singapore underlying indices / Singapore stocks: 09:00am to 12:00pm; 01:00pm to 05:00pm

DLCs on US underlying indices: 09:00am to 12:00pm; 01:00pm to 05:00pm

For details on market making relating to DLCs with US underlying indices, read more here.

A good market making is defined by competitive bid/ask spread, adequate quoting size and consistency of the two.

Below is the tick rule of DLC defined by SGX:

| Price Range | Minimum Tick |

|---|---|

| 0.001 to 0.199 | 0.001 |

| 0.2 to 1.995 | 0.005 |

| 2 and above | 0.010 |

| Price Range | Maximum Spread |

|---|---|

| 0.001 to 10 | 10 ticks or S$0.20 whichever is greater |

| 10.01 and above | 5% of the best bid price of the Certificate |

For every DLC with certain underlying, leverage and direction, Societe Generale strives to keep a consistent percentage spread taking into account its hedging cost. As a result, for two DLCs of the same Underlying Asset, leverage and direction, given they are in the same price range, the higher-price DLC may be of wider number of ticks, while the percentage spread is kept the same.

Because DLCs are listed on the security market of an exchange, in theory all investors who have a stock brokerage account can already trade DLCs. There is no need to open any account with Societe Generale.

Investors should, however, check with their brokers to make sure they are qualified to trade Specified Investment Products (SIPs). DLCs are examples of SIPs. The Monetary Authority of Singapore (MAS) has introduced measures for intermediaries to safeguard the interests of individual investors investing in SIPs, which are products with features that might be more complex in nature. Investors can to assess their qualifications to trade SIP or enhance their product knowledge through the SGX online portal available on https://onlineeducation.sgx.com/specifiedinvestmentproducts/.

| These products may be right for you if: | These products may not be right for you if: | ||

|---|---|---|---|

| You will hold the investment for less than a day. | You are looking to hold the investment long term. | ||

| You will hold the investment for more than a day, but understand that gains and losses will be compounded and certain additional costs and fees will be factored in. | You do not understand the impact of compounding on your investment returns and you do not wish to pay certain additional costs and fees on positions held for more than a day. | ||

| You would like the opportunity to gain a return of 2, 3, 5 or 7 times the daily rise or fall of the Underlying Asset. | You do not want to take the risk that your gains or losses would be multiplied by 2, 3, 5 or 7 times. | ||

| You understand that the Air Bag Mechanism is designed to reduce the actual exposure of the Daily Leverage Certificates to changes in the Underlying Asset in case of significant adverse movement in the Underlying Asset during the day. It may however lead to underperformance if the Underlying Asset recovers later that Trading Day. | You do not want to potentially underperform the Underlying Asset should the Air Bag Mechanism be activated, followed by a recovery in the Underlying Asset. | ||

| You appreciate that your entire capital is at risk but you will never lose more than you invested. | You do not want to risk any of your capital. | ||

| You are SIP qualified. | You are not, or you are not prepared to become SIP qualified. | ||