Daily Leverage Certificates

DLC Hotline: (65) 6226 2828

The theme this year was anchored on the idea of navigating life milestones: at different life stages, investors will have to face challenges and need to adopt different investment strategies to meet their life goals. Participants listened to a line-up of presentations by distinguished industry experts who shared their views, provide practical investment insights on 2019 Market Outlook and Key Investment Themes that would be helpful for investors in building their portfolio.

At this one-day event, Societe Generale had set up a dedicated booth and a 30-min presentation to introduce “Daily Leverage Certificates (DLC)” to the participants. This is part of SG’s ongoing efforts to engage, educate and encourage new investors to understand this leverage trading instruments listed on SGX. Over 500 attendees come to our DLC booth and spoke with our product specialists to learn more about it. Most of the attendees showed interests on the newly launched stock-based DLCs that offer exposure to oil and gas, telecommunications, property, technology and financial companies. They were actively raising questions they might have about investing in it and how to make use of it during the rising and falling markets.

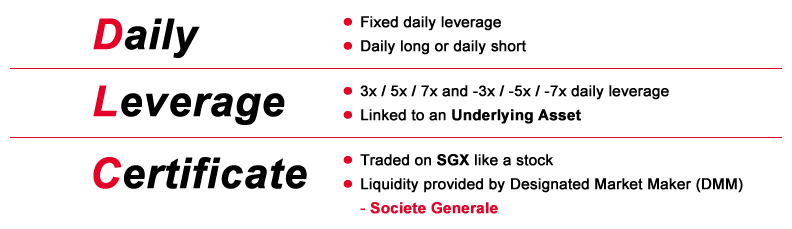

Daily Leverage Certificates (DLC) are exchange-traded financial products that enable investors to take a leveraged exposure to an underlying asset. DLC replicates the performance of an underlying asset versus its previous day closing level, with a fixed leverage.

For bullish investors who think that an Underlying Asset is set to rise over the Trading Day they can trade Daily Long. Daily Longs will generate a positive return by leveraging any rise in the Underlying Asset.

On the other hand, for investors who hold a bearish view and expect the Underlying Asset to fall, they could select Daily Short which will generate a positive return by leveraging any fall in the Underlying Asset.

For more information, please visit our product handbook, Guide to Daily Leverage Certificates (DLC) at https://dlc.socgen.com/en/education/handbook

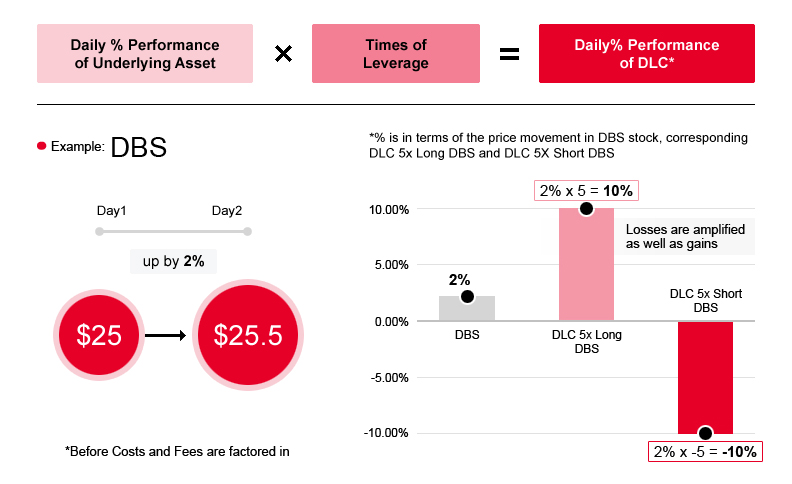

DLC leverages the daily performance of an underlying asset by a fixed factor up to 7 times. Depending on how far markets move in one day, active trading can be a limited endeavour unless investors are trading in sizeable quantities, particularly when the trading costs are taken into account.

In this example, for investors who want to maximise their short-term exposure to market movements, Daily Leverage Certificates can provide the opportunity to increase the exposure by a fixed factor, up to 5 times. This means that a SGD1,000 position in a 5 times Daily Leverage Certificates can provide the same exposure as SGD5,000 invested directly in the Underlying Asset. This represents leverage of 5 times, and it simply means that every 1% movement in the Underlying Asset translates to a 5% move in the price of your Daily Leverage Certificates that day.

For more information, please visit our product handbook, Guide to Daily Leverage Certificates (DLC) at https://dlc.socgen.com/en/education/handbook

The Air Bag Mechanism is a safety mechanism that is built into the Daily Leverage Certificates. It is designed to reduce the negative impact of an extreme move in the Underlying Asset during the day.

In more volatile markets, the Air Bag Mechanism can provide some valuable loss protection to investors.

For more information, please visit our product handbook, Guide to Daily Leverage Certificates (DLC) at https://dlc.socgen.com/en/education/handbook

| Underlying Type | Leverage | Airbag Trigger Level |

|---|---|---|

| Index | 3x | 20% |

| 5x | 10% | |

| 7x | 10% | |

| Stock | 5x | 15% |

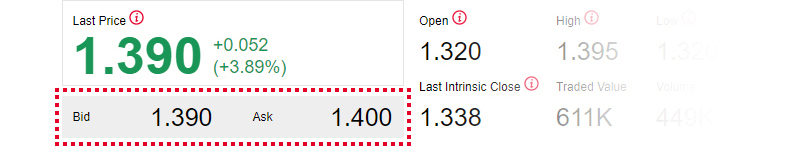

When the investors trade intra-day (buying and selling the DLCs on the same trading day), the costs are the brokerage fees, trading fees and Bid/Ask Spread from trading which are typically the same as trading stocks on the relevant exchange. The leverage and hedging costs and fees will only apply when the DLCs are held overnight.

| Fee Type | DLC | Stock |

|---|---|---|

| Trading access fee | 0.001% | 0.0075% |

| Clearing fee | 0.004% | 0.0325% |

| Brokerage fee | Determined by broker | Determined by broker |

| Trading intra-day | Held overnight | |

|---|---|---|

| Brokerage Fee | ||

| Bid/Ask Spread | ||

| Funding Cost* | ||

| Rebalancing Costs* | ||

| Gap Premium | ||

| Management Fee |

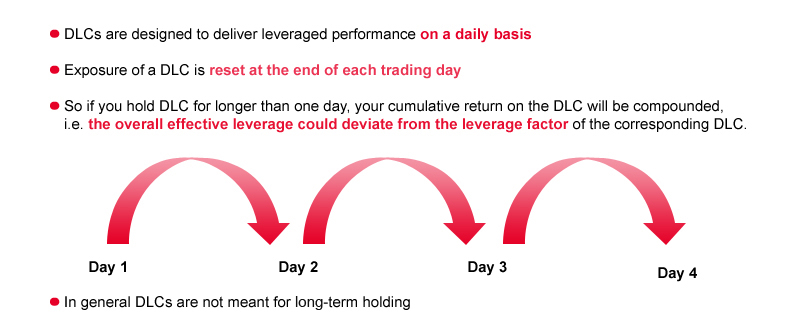

The performances of the Underlying Asset and the DLCs are reset at the end of each Trading Day.

When markets open on the next day, the performances of the Underlying Asset and the DLCs will be measured from the closing levels recorded on the previous Trading Day.

What this means, in practice, is the performance each day is locked in, and any subsequent returns are based on what was achieved the day before. This is a process referred to as 'compounding'. The compounding effect can positively enhance returns in trending markets (upward or downward) whilst negatively impacting returns when the markets are more volatile or trend sideways for long periods. The effect of this compounding is further amplified as daily returns are leveraged.

For more information, please visit our product handbook, Guide to Daily Leverage Certificates (DLC) at https://dlc.socgen.com/en/education/handbook

Go to our website DLC.socgen.com and subscribe to our DLC daily newsletter!

Our DLC website provides with more detailed info about DLCs, such as live prices, price matrix, simulator etc. We also sent out daily newsletter to our members and host a weekly webcast on the website. Subscribe to our newsletter and stay tuned!