Daily Leverage Certificates

DLC Hotline: (65) 6226 2828

Market Commentary (Hong Kong) for the week ending 07 June 2024

Markets whipsawed between ‘hike’ and ‘no hike’ narratives. Nasdaq 100 made new all time high while Russell 2000 index printed third consecutive down week. Gold and US treasury yields are sending out mixed signals.

● Turkey announced its intention to join the BRICS instead of the EU.

● Qatar Investment Authority reportedly agreed to buy a 10 percent stake in China’s second largest mutual fund firm.

● Warren Buffet partnered with Occidental Petroleum to produce battery-grade lithium.

● The ECB cut its policy rates by 25 basis points to 3.75%; this is the first cut since 2019.

● G7 and the EU prepare sanctions against third country banks using Russia’s financial messaging system.

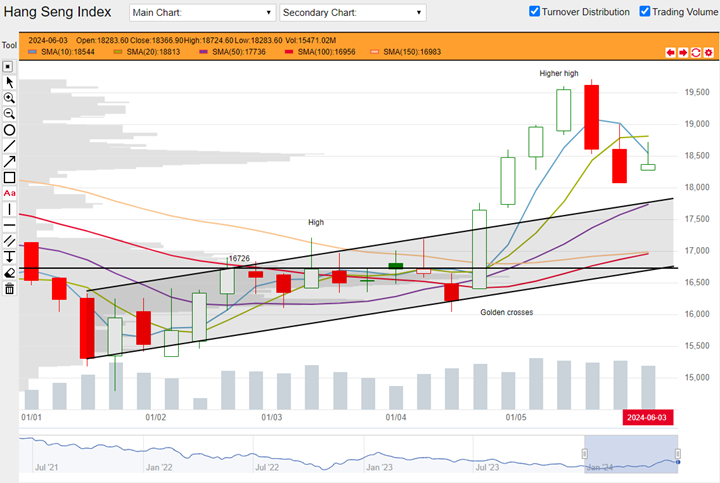

Hang Seng Index closed this week at 18367, down 287 points or 1.59%. The index closed as an inside week with a small upside from the week's open. The index is now trading below its 10 and 20-Day SMAs but above the longer averages. Longer averages and the recent higher swing high are associated with further gains although short term momentum could be capped.

HSI weekly chart from 01 January 2024 to 07 June 2024 (Source: DLC.socgen.com)

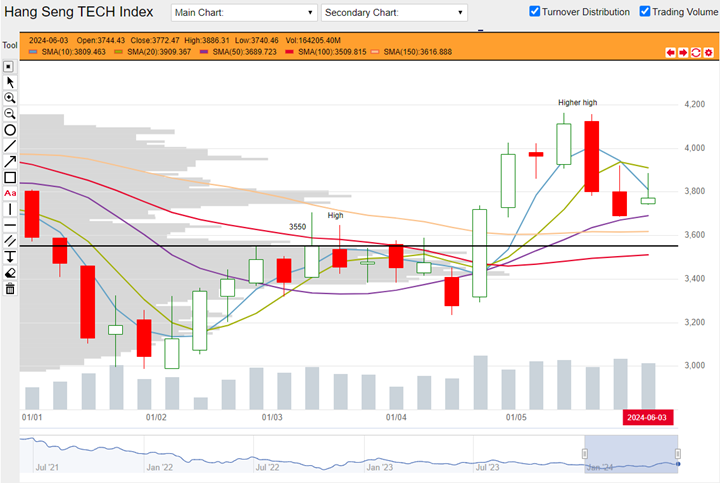

Hang Seng Tech closed the week at 3772, down 82 points or 2.21%. HSTech has the same technical setup as HSI. Longer averages and the recent higher swing high are associated with further gains but short term upside could be capped by 10 and 20-Day SMAs positioned above. Market could be looking for a bottom at the moment.

HSTech weekly chart from 01 January 2024 to 07 June 2024 (Source: DLC.socgen.com)

The Nasdaq 100 made a new all-time high while the Dow printed an inside week and the Russell 2000 made consecutive third week low. We are probably looking at an ‘AI revolution’ versus an old economy divergence.

The next FOMC meeting is scheduled on 12 June 2024.

Fed funds futures on rate hike probability by next Fed meeting as at this week’s close:

● 2.2% probability of 25 basis points cut |97.8% probability of no change

Fed funds futures on rate hike probability by next Fed meeting at last week’s close:

● 4.4% probability of 25 basis points cut |95.6% probability of no change

Probabilities on the CME Fedwatch Tool indicate a 25-basis points cut could start as early as the coming FOMC meeting in June. There is also a possibility for a cumulative 100 basis points cut between now to December this year.

Both Shanghai and Shenzhen fell for the third week in a row. Shanghai built a higher swing high and has a series of golden crosses in its moving averages that could be associated with further gains despite the current correction.

Other news:

● AIA, Tencent, Wuxi Bio and Xiaomi bought back shares.

● China Mobile, CNOOC, Cosco Shipping and PetroChina printed new 52-week highs. Wuxi Biologics printed a new 52-week low.

Technical observations

Alibaba 9988.hk ended the week with an inside bar, perched on multiple swing highs.

Note chart features:

1. Alibaba has a recent higher swing high compared to previous peaks printed in December last year and February this year. In conjunction with a number of golden crosses in its moving averages, this is a setup associated with further gains. In this light, the recent correction could be a retracement to look for support.

2. This week Alibaba printed an inside week. This week’s low and last’s is perched on a zone between $74.55 - $75.60. These values are drawn from the highest end-of-week close from two previous tops. Those were previous resistance levels. These levels could have some meaning to the market and these two weeks’ close could be a nod to these levels.

3. Longer moving averages below could provide potential support. Overhead, the stock could be capped by its 10 and 20-Day SMAs

Alibaba 9988.hk weekly chart from 02 October 2023 to 07 June 2024. (Source: DLC.socgen.com)

Underlying Index/Stock |

Underlying Chg (%)1 |

Long DLC (Bid Change%2) |

Short DLC (Bid Change%2) |

|---|---|---|---|

| Hang Seng Index (HSI) | -1.20% | RQGW (-5.38%) | WIEW (+3.14%) |

| Hang Seng TECH Index (HSTECH) | -2.48% | ECJW (-5.73%) | 9B2W (+10.77%) |

| Alibaba (9988.HK) | -3.56% | RUMW (-12.17%) | XOZW (+11.63%) |

Brought to you by SG DLC Team

This advertisement has not been reviewed by the Monetary Authority of Singapore. This advertisement is distributed by Société Générale, Singapore Branch. This advertisement does not form part of any offer or invitation to buy or sell any daily leverage certificates (the “DLCs”), and nothing herein should be considered as financial advice or recommendation. The price may rise and fall in value rapidly and holders may lose all of their investment. Any past performance is not indicative of future performance. Investments in DLCs carry significant risks, please see dlc.socgen.com for further information and relevant risks. The DLCs are for specified investment products (SIP) qualified investors only.

Full Disclaimer - here